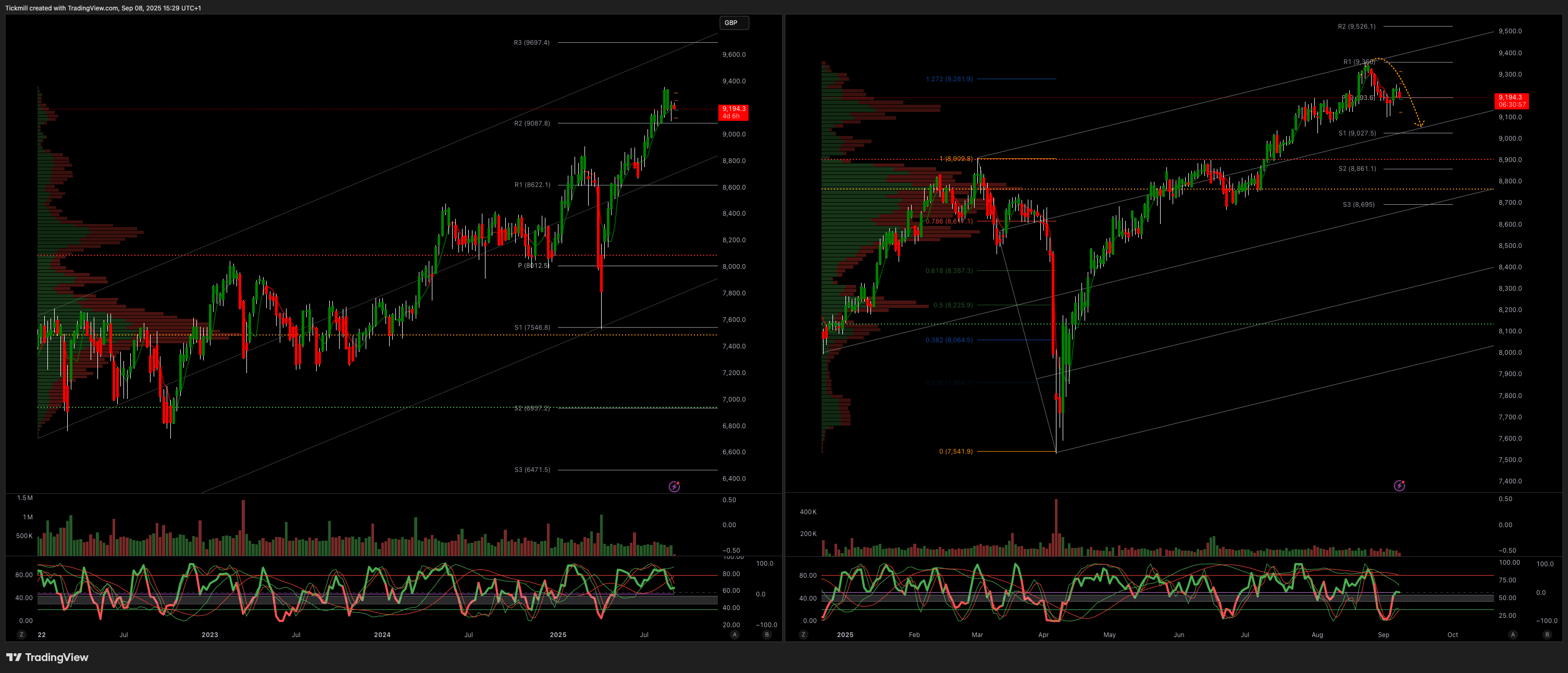

The FTSE Finish Line 8/9/25

The FTSE Finish Line

The U.K.'s benchmark index, FTSE 100, edged down in late trading on Monday as investors focused on stock-specific moves driven by corporate news and shifts in commodity markets. Attention remains centred on the confidence vote in France this afternoon. Optimism around a potential Federal Reserve rate cut next week appears to be providing some support to market sentiment. However, surveys reveal a troubling trend in wage growth, with British employers offering the lowest pay settlements in over three and a half years as of July. This slowdown in wage increases coincides with a deceleration in hiring activity, raising concerns about the health of the U.K. job market. These developments reflect mounting apprehensions among businesses about the possibility of further tax hikes, particularly with the upcoming budget announcement by Finance Minister Rachel Reeves scheduled for November 26. Such fears suggest employers may be preparing for additional financial strain, potentially limiting their capacity to offer competitive salaries or expand their workforce. This underscores the importance of strategic planning amid ongoing economic uncertainty.

Shares of British retailer Marks & Spencer have risen by 1.8%, now trading at 348.3 pence. The stock has become the top gainer on the FTSE 100 index today. A recent upgrade by Citi has positively impacted the stock; they changed their rating from 'Neutral' to 'Buy' and raised the target price significantly from 380 pence to 440 pence. This upgrade is based on the company's capacity to mitigate the financial repercussions from a recent cyber incident that is expected to unfold by the first half of 2026. Among the analysts covering Marks & Spencer, 13 out of 15 hold a "buy" or higher rating on the stock, while 2 analysts have given it a "hold" rating. The median price target from these analysts stands at 426.36 pence, as per data compiled by LSEG. Despite the session's gains, the stock is still down over 10% year-to-date (YTD), indicating that it has faced challenges in the market earlier in the year.

Shares of the UK's Phoenix Group have experienced a significant decline, dropping 4.5% to 640p in response to their half-year (H1) earnings results. The company has emerged as the top percentage loser on the FTSE 100 index, which has only seen a minor increase of 0.07% during the same trading session. The insurer reported a loss after tax amounting to £156 million ($210.83 million). This figure, along with an adjusted shareholders' equity of £3.4 billion, has fallen short of projections made by JPMorgan, suggesting potential concerns regarding the company's financial health. However, in a more positive light, Phoenix Group did post an adjusted operating profit of £451 million, surpassing JPMorgan's estimate of £445 million and showing an improvement from £360 million in the previous year. Despite the stronger performance in operating profit, JPMorgan has indicated that the weak loss after tax and equity metrics might overshadow what they consider a robust operating performance. Nonetheless, the company has decided to maintain its full-year outlook without any changes. As a reflection of the market's reaction to this earnings report, including the movements throughout the trading session, the stock of Phoenix Group is now down 3.7% year-to-date (YTD).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!