SP500 LDN TRADING UPDATE 7/10/25

SP500 LDN TRADING UPDATE 7/10/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~61 POINTS***

WEEKLY BULL BEAR ZONE 6720/10

WEEKLY RANGE RES 6791 SUP 6640

OCT EOM STRADDLE 6602/6891

OCT MOPEX 6842/6487

DEC QOPEX 6303/7025

DAILY VWAP BULLISH 6749

WEEKLY VWAP BULLISH 6655

DAILY ONE TIME FRAMING HIGHER - 6754

DAILY BULL BEAR ZONE 6750/40

DAILY RANGE RES 6847 SUP 6732

2 SIGMA RES 6905 SUP 6675

VIX DAILY BULL BEAR ZONE 18.5

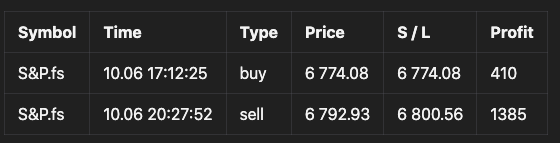

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

JPMORGAN TRADING DESK VIEWS

IDEAS & INSIGHTS – IN BRIEF

OpenAI & AMD Deal: Views from JPM Spec Sales Josh Meyers highlight the implications of the recent partnership. Trading Desk Commentary provides insights on consumer stocks like Starbucks (SBUX) and PepsiCo (PEP), as well as Japan ETFs. The Econ & FICC Bullets section shares perspectives from JPM Research.

AFTERNOON UPDATES

The S&P 500 (SPX) is up 0.4%, the Nasdaq 100 (NDX) is up 0.8%, and the Russell 2000 (RTY) is up 0.4%. WTI crude oil increased by 133 basis points to $61.69, natural gas rose by 99 basis points to $3.36, and UK natural gas climbed 570 basis points to £0.8517. Gold is up 192 basis points to $3,961, silver increased by 107 basis points to $48.51, the 10-year yield is at 4.152%, and the VIX is at 16.37.

In the US, stocks closed higher, led by the tech sector. Catalysts remain muted due to the government shutdown delaying data releases. The OpenAI/AMD deal sparked a rally in AI and tech stocks, with AMD gaining 25% today. Outside of tech, rare earth stocks, crypto exposure, and meme stocks performed well, while retail and housing lagged. Political developments in Japan and France were focal points over the weekend.

In the EU and UK, major markets closed modestly lower, with France lagging. AI positive sentiment, renewables, and AI datacenters were among the top performers, while UK and EU defense stocks lagged. The UKX was down 0.1%, SX5E down 0.4%, SXXP down 0.0%, and DAX down 0.0%.

CATALYSTS TODAY (WEEK AHEAD)

US macro data is scheduled for tomorrow, including the Trade Balance, Exports, and Imports at 8:30 AM ET, NY Fed 1-Year Inflation Expectations at 11 AM ET, and Consumer Credit at 3 PM ET. US earnings will feature MKC tomorrow. Global macro data includes Germany's Factory Orders at 2 AM ET, Japan's Leading Index CI at 1 AM ET, and Japan's Labor Cash Earnings at 7:30 PM ET.

JPM MARKET INTEL EQUITY & MACRO NARRATIVE

Stocks closed higher, driven by tech due to limited macro data and the OpenAI/AMD deal, with AMD accounting for about 30% of the SPX's total gains today. However, the rally was narrow, with 52% of SPX stocks finishing lower. Investor conversations indicate concerns over AI and tech valuations as earnings season approaches.

Regarding AI and tech into earnings season, recent client discussions reflect worries about positioning and valuation, especially concerning the Magnificent Seven. Positioning data shows that the recent rally has brought positions back to highs (L/S ratio around the 98th percentile and net exposure over 2z). Earnings growth estimates for tech have risen to 20.9% from 15.9% as of June 30, according to FactSet. Notably, 81% of tech stocks have seen EPS estimate increases, led by NVIDIA (from $1.17 to $1.24) and Apple (from $1.65 to $1.76). These positive revisions could set a higher bar for the upcoming earnings season. Year-to-date, tech and communication services have gained 22.7% and 22.4%, respectively, compared to the SPX's total return of 14.2%.

While the resilience of the US economy and consumers is expected to continue supporting equities, leading to a broadening of the rally, this may come at the expense of technology, media, and telecommunications (TMT) sectors. To capitalize on this broadening trend, excluding TMT, a preference for cyclical sectors such as financials is maintained, especially in light of positive consumer comments from major banks during a recent September industry conference.

TRADING DESK COMMENTARY

Briggs Barton (Consumer) – SBUX: Weakness in Starbucks (SBUX) is driven by a negative article from the Wall Street Journal titled "Starbucks Roller Coaster Week of Job Cuts and Store Closures." The report highlights that SBUX is forced to reduce its store footprint, complicating its turnaround initiatives amid a challenging macro landscape. Despite initial expectations, the stock has been negatively impacted as hedge funds express skepticism about the company's execution. The article describes a tumultuous week in late September, during which Starbucks abruptly closed hundreds of stores and laid off thousands of employees. Customers have vented their frustrations online, questioning their loyalty, while baristas shared emotional TikTok videos after receiving layoff notices. Alumni of Starbucks have offered support to those affected, and criticism surrounding the cuts and closures has emerged.

Paige Hanson (Industrials): The government shutdown will enter its second week on Wednesday, with no clear resolution in sight. Historically, past shutdowns have had minimal lasting effects on defense contractors and have not consistently led to underperformance in their stocks, particularly after a shutdown has commenced. Notably, defense coverage outperformed the market last week, including services contractors typically viewed as vulnerable. While shutdowns are uncommon and each situation is unique, the assessment of a potentially prolonged shutdown will be refined as more information becomes available. The Department of Defense (DoD) is expected to have some protection from the shutdown's impact due to the critical nature of its work, the absence of targeted federal spending cuts, and the $150 billion allocated to the department in the reconciliation bill.

Briggs Barton (Consumer) – PEP Preview: For PepsiCo (PEP), there are no expectations for significant sequential improvement. The focus remains on activist involvement, which is creating a sense of urgency and focus within the company. Estimates for Q3 2025 remain unchanged, projecting organic sales growth (OSG) of +1.9% for 2025 and EPS of $2.28, compared to consensus estimates of OSG +2.1% and EPS of $2.27. The price target has been adjusted to $151 from $157, based on a 16.8x P/E ratio, reflecting a premium to the average of multinational beverage, household products, and food peers. The recommendation remains Neutral, advising to stay on the sidelines.

Jonathan Rogerson (ETFs) – Big in Japan: There has been significant interest in ETFs, with $18 billion in inflows last week. Key sectors driving this include Financials (+$1.2 billion), Semiconductors (SMH +$0.9 billion), and Healthcare (+$0.7 billion), while Large Cap Growth (VUG/IWF) experienced outflows of $1.3 billion. Strength is observed in model portfolio names (DYNF/BAI/OEF), indicating healthy passive inflows as we approach Q4. Internationally, China is regaining attention, with real money buyers entering CQQQ (China Technology) during the Golden Week closure, while redemptions are occurring in EMXC (Emerging Markets Ex-China), which serves as a sentiment bellwether among emerging market investors regarding China. Anticipation for demand in Japan trackers (BJP, EWJ, DXJ, FLJP) is expected following the pro-stimulus victory of Takaichi in the LDP leadership contest, although yen weakness is tempering the impressive overnight gains in local markets (NKY +4.75%, TPX +3.1%).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!