SP500 LDN TRADING UPDATE 16/9/25

SP500 LDN TRADING UPDATE 16/9/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~61 POINTS***

WEEKLY BULL BEAR ZONE 6625/15

WEEKLY RANGE RES 6710 SUP 6570

SEP MOPEX STRADDLE - 6260/6639

SEP EOM STRADDLE - 6282/6638

DAILY BULL BEAR ZONE 6560/50

DAILY RANGE RES 6674 SUP 6556

2 SIGMA RES 6737 SUP 6497

VIX DAILY BULL BEAR ZONE 15.75

DAILY MARKET CONDITION - ONE TIME FRAMING UP 6663

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

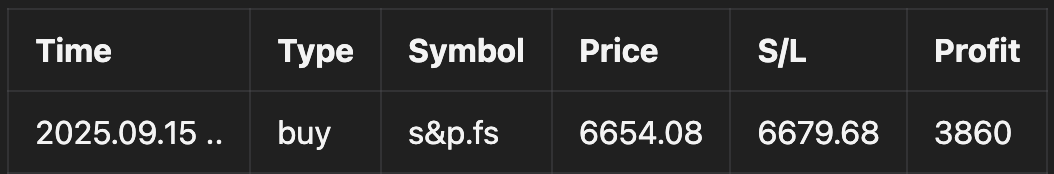

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON TEST/REJECT WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: GRADUAL GAINS

FICC and Equities | 15 September 2025 |

Market Performance:

- S&P 500: +47bps, closing at 6,615. MOC flows insignificant.

- NASDAQ 100 (NDX): +84bps, ending at 24,293.

- Russell 2000 (R2K): +31bps, closing at 2,423.

- Dow Jones: +11bps, finishing at 45,883.

Trading volume reached 17.6 billion shares across U.S. equity exchanges, surpassing the year-to-date daily average of 16.8 billion shares.

Volatility & Commodities:

- VIX: +623bps, closing at 15.68.

- WTI Crude: +99bps, priced at $63.31.

- U.S. 10-Year Treasury Yield: -2bps, at 4.03%.

- Gold: -92bps, settling at $3,720.

- DXY (Dollar Index): -23bps, at 97.32.

- Bitcoin: -38bps, priced at $115,000.

The NASDAQ 100 extended its winning streak to nine consecutive days, marking the longest rally in nearly two years.

Sector Highlights:

Activity levels were muted overall, with notable moves in big tech:

1. Tesla (TSLA): +3%, driven by Elon Musk's $1 billion stock purchase, as revealed in a recent filing.

2. Alphabet (GOOG): +3.5%, buoyed by Gemini app's #1 ranking in the U.S. App Store, fueled by 'Nano Banana' momentum.

3. Apple (AAPL): +1%, supported by record-breaking Chinese pre-orders for the iPhone 17.

4. NVIDIA (NVDA): Slight decline amid reports of a potential antitrust probe related to Mellanox.

Our trading floor activity rated a 4 on a 1–10 scale. The floor closed at -307bps for sales versus a 30-day average of -55bps. Long-only funds were small net buyers, with tech purchases offsetting healthcare sales. Notional net buying in global Info Tech last week was the largest in seven months, ranking in the 99th percentile on a five-year lookback.

Hedge funds ended as small net sellers, driven by supply in tech, financials, and discretionary sectors. U.S. cyclical sectors saw net selling for the sixth consecutive week, with short sales outpacing long buys at a ratio of 1.4:1. Since reaching a two-year high in early August, the U.S. cyclicals long/short ratio has declined by 7% to 1.73, placing it in the 71st percentile over the past year and the 38th percentile over the past five years.

IPO Calendar:

The IPO pipeline remains active, with STUB, WBI, and PTRN set to debut this week.

Upcoming Events:

Key focus remains on tomorrow's Retail Sales report and Wednesday's FOMC meeting, especially after this morning’s weaker-than-expected Empire Manufacturing data. We anticipate three consecutive 25bps rate cuts in September, October, and December, followed by two additional cuts next year, bringing rates to 3–3.25%.

Derivatives Activity:

Call options dominated the tape today, accounting for over 64% of activity (highest YTD). The daily straddle closed near 30bps, one of the lowest levels YTD. Notably, the delta-adjusted front-month VIX future rose by 0.6v, indicating a stronger move in volatility relative to the spot change.

Our desk recommends owning event volatility ahead of the FOMC meeting, as short-dated optionality appears mispriced. This strategy serves as a hedge or delta replacement, offering attractive opportunities. However, significant gamma positioning by dealers, particularly around the 6,500 level, could limit dramatic selloffs in equities.

The Wednesday straddle is priced at 0.75%, while Friday's sits at 1.12%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!